Exactly How Livestock Threat Security (LRP) Insurance Can Protect Your Livestock Investment

In the world of livestock financial investments, mitigating risks is vital to ensuring economic stability and development. Animals Danger Protection (LRP) insurance policy stands as a trusted shield versus the unforeseeable nature of the market, offering a calculated method to guarding your properties. By diving right into the details of LRP insurance and its complex benefits, livestock manufacturers can fortify their investments with a layer of protection that goes beyond market changes. As we explore the world of LRP insurance, its function in protecting animals investments ends up being significantly apparent, guaranteeing a course towards sustainable monetary strength in an unpredictable industry.

Comprehending Animals Danger Protection (LRP) Insurance Coverage

Understanding Livestock Risk Defense (LRP) Insurance coverage is vital for livestock producers looking to minimize monetary risks related to cost variations. LRP is a government subsidized insurance policy product designed to shield manufacturers versus a drop in market value. By giving protection for market price declines, LRP helps manufacturers secure a flooring price for their animals, making sure a minimum level of revenue despite market fluctuations.

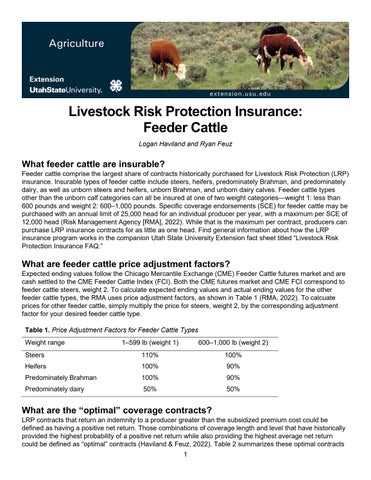

One secret aspect of LRP is its versatility, allowing manufacturers to tailor protection degrees and policy sizes to match their particular demands. Producers can select the variety of head, weight variety, insurance coverage price, and protection duration that align with their production objectives and risk tolerance. Recognizing these customizable choices is essential for producers to properly manage their price danger direct exposure.

Moreover, LRP is offered for numerous livestock types, including cattle, swine, and lamb, making it a functional danger management device for livestock producers throughout different industries. Bagley Risk Management. By acquainting themselves with the details of LRP, manufacturers can make informed decisions to secure their financial investments and make certain financial stability in the face of market uncertainties

Benefits of LRP Insurance Coverage for Animals Producers

Animals manufacturers leveraging Animals Threat Defense (LRP) Insurance policy gain a calculated benefit in protecting their financial investments from cost volatility and safeguarding a secure financial footing among market uncertainties. One vital advantage of LRP Insurance is cost security. By establishing a floor on the price of their livestock, manufacturers can alleviate the threat of substantial economic losses in the event of market declines. This enables them to prepare their budgets better and make notified choices about their procedures without the constant worry of price fluctuations.

Additionally, LRP Insurance policy gives manufacturers with tranquility of mind. On the whole, the advantages of LRP Insurance policy for animals producers are considerable, offering a valuable tool for managing danger and making sure financial security in an unforeseeable market atmosphere.

Just How LRP Insurance Policy Mitigates Market Risks

Alleviating market risks, Animals Danger Defense (LRP) Insurance coverage supplies livestock manufacturers with a trustworthy shield versus cost volatility and financial unpredictabilities. By using defense against unanticipated cost declines, LRP Insurance policy helps manufacturers protect their financial investments and preserve financial security despite market changes. This sort of insurance policy permits livestock producers to secure in a rate for their pets at the beginning of the plan period, ensuring a minimum rate degree despite market changes.

Actions to Safeguard Your Livestock Financial Investment With LRP

In the world of farming danger administration, carrying out Livestock Threat Defense (LRP) Insurance policy entails a critical procedure to guard financial investments versus market variations and unpredictabilities. To protect your livestock investment efficiently with LRP, the very first step is to examine the details dangers your operation faces, such as price volatility or unanticipated climate occasions. Recognizing these dangers allows you to determine the insurance coverage degree needed to safeguard your investment sufficiently. Next, it is crucial to study and choose a trustworthy insurance policy supplier that uses LRP policies customized to your livestock and business demands. When you have actually picked a carrier, very carefully evaluate the plan terms, conditions, and coverage limits to ensure they line up with your risk monitoring goals. In addition, frequently checking market trends and readjusting your protection as required can aid optimize your protection against possible losses. By complying with these steps diligently, you can enhance the safety and security of your animals financial investment and browse market unpredictabilities with self-confidence.

Long-Term Financial Security With LRP Insurance

Guaranteeing enduring monetary stability with the hop over to these guys usage of Animals Threat Defense (LRP) Insurance is a prudent lasting approach for farming manufacturers. By including LRP Insurance policy right into their danger administration strategies, farmers can protect their animals financial investments versus unanticipated market changes and unfavorable events that can threaten their monetary wellness in time.

One key advantage of LRP Insurance policy for long-lasting financial security is the comfort it supplies. With a reliable insurance plan in place, farmers can mitigate the economic dangers related to unpredictable market problems and unexpected losses as a result of aspects such as disease episodes or natural disasters - Bagley Risk Management. This security allows manufacturers to focus on the everyday operations of their animals service without constant bother with possible monetary troubles

Additionally, LRP Insurance provides a structured approach to taking care of danger over the long term. By establishing details coverage degrees and selecting suitable recommendation periods, farmers can tailor their insurance policy plans to straighten with their financial objectives and risk tolerance, making certain a secure and sustainable future for their animals procedures. Finally, spending in LRP Insurance policy is a proactive method for farming manufacturers to achieve long lasting economic security and safeguard their source of incomes.

Conclusion

Finally, Animals Risk Protection (LRP) Insurance coverage is a useful device for animals manufacturers to reduce market dangers and protect their financial investments. By recognizing the advantages of LRP insurance and taking steps to implement it, producers can accomplish long-lasting monetary safety for their procedures. LRP insurance policy gives a safety and security web versus rate variations and ensures a degree of security in an uncertain market environment. It is a wise option for protecting livestock investments.